sacramento county tax rate

Tax Rate Areas Sacramento County 2021. Sacramento County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Sacramento County totaling 025.

It S Amazing To See Housing Inventory In The Sacramento Area Over The Past Decade Sacramento County 10 Years County

Method to calculate Sacramento County sales tax in 2021.

. Whether you are already a resident or just considering moving to Sacramento County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. T he tax rate is 55 for each 500 or fractional part thereof of the value of real property less any loans assumed by the buyer. The 2018 United States Supreme Court decision in South Dakota v.

Automating sales tax compliance can help your business keep compliant with changing sales tax laws. The sales tax rate for Sacramento County in the state of California as on 1st January 2020 varies from 775 to 875 depending upon in. The Sacramento County sales tax rate is 025.

T he tax rate is. 6 rows The Sacramento County California sales tax is 775 consisting of 600 California state. You can find more tax rates and allowances for Sacramento County and California in.

The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable. To view a history of the statewide sales and use tax rate please go to the History of Statewide Sales Use Tax Rates page. Did South Dakota v.

Postal Service postmark Contact Information. 55 for each 500 or fractional part thereof of the value of real property less any loans assumed by the buyer. TaxSecured saccountygov FAQ.

Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143 counties in order of. The tax is imposed on all transfers by deeds. Dept Content HP Col4.

Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. The average sales tax rate in California is 8551. The median property tax on a 32420000 house is 340410 in the United States.

The December 2020 total. 2021-2022 compilation of tax rates by code area code area 03-035 code area 03-036 code area 03-037 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00249 los rios coll gob 00249 los rios coll gob 00249 sacto unified gob 00918 sacto unified gob 00918 sacto unified gob 00918. 1788 rows Sacramento.

For purchase information please see our Fee Schedule web page or contact the Assessors Office public counter at 916 875-0700. How much is the documentary transfer tax. Box 508 Sacramento CA 95812-0508 Please ensure that mailed payments have a US.

View the E-Prop-Tax page for more information. How much is county transfer tax in Sacramento County. Has impacted many state nexus laws and sales tax collection requirements.

The Sacramento sales tax rate is. Our Mission - We provide equitable timely and accurate property tax. Each TRA is assigned a six-digit numeric identifier referred to as a TRA number.

The California sales tax rate is currently. To review the rules in California visit our state-by-state guide. The minimum combined 2022 sales tax rate for Sacramento California is.

This calculator can only provide you with a rough estimate of your tax liabilities based on the. Property information and maps are available for review using the Parcel Viewer Application. The Assessors office electronically maintains its own parcel maps for all property within Sacramento County.

In Sacramento County only the City of Sacramento has established a City Transfer Tax Sacramento City Code section 316020 and does not receive any DTT revenue. Compilation of Tax Rates by Code Area. The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. What is the sales tax rate in Sacramento California. Tax Collection and Licensing.

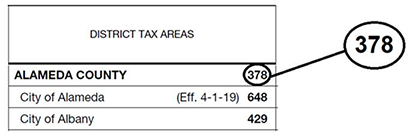

A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the regular city or county assessment roll per Government Code 54900. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. This is the total of state county and city sales tax rates.

The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. Our Responsibility - The Assessor is elected by the people of Sacramento County and is responsible for locating taxable property in the County assessing the value identifying the owner and publishing annual and supplemental assessment rolls. Sacramento County collects relatively high property taxes and is ranked in the top half of all counties in the United States by.

Learn all about Sacramento County real estate tax. A county-wide sales tax rate of 025 is. The County sales tax rate is.

The median property tax on a 32420000 house is 239908 in California. The current total local sales tax rate in Sacramento CA is 8750. The current total local sales tax rate in Sacramento County CA is 7750.

36 rows The Sacramento County Sales Tax is 025. The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and a median effective property tax rate of 068 of property value. Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail Additional Information.

The median property tax on a 32420000 house is 220456 in Sacramento County. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc.

Trade Management Market To Witness Astonishing Growth With Key Players Ocr Service Cognizant Thomas R Competitive Analysis Marketing Data Process Improvement

Information For Local Jurisdictions And Districts

Sacramento County Sales Tax Rates Calculator

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

Real Estate Heading In The Right Direction Home Ownership Real Estate Real Estate News

What Are California S Income Tax Brackets Rjs Law Tax Attorney

Sacramento Appraisal Blog Real Estate Appraiser Appraisal Challenges Mortgage Loan Originator

Pin Pa Why Is Capital Poor And The Worker Losing Fn

Column Five Media Turbotax Infographic America S Most Bizarre Taxes

Property Taxes Department Of Tax And Collections County Of Santa Clara

Capital Gains Tax Explained Propertyinvestment Flip Investing Knowthenumbers Capital Gains Tax Capital Gain Money Isn T Everything

Cost Or Renting Vs Buying Rent Vs Buy Best Mortgage Lenders Mortgage Payoff

El Dorado County Market Update May 2016 Courtesy Of Jennifer Teie Realtor 916 952 1665 El Dorado County Marketing One Year Ago

Franchise Tax Board Homepage Tax Franchising California State

Sacramento County Transfer Tax Who Pays What

Sacramento California Tourist Spots Google Search California Tourist Spots Sacramento Valley Sacramento Airport

Column Five Media Turbotax Infographic America S Most Bizarre Taxes

We Re Providing The Best Taxi Service In Rocklin To Sacramento And Smf Rocklin Taxi Taxi Service

Homes Are Selling 8 Days Faster This Spring Says Realtor Com Real Estate News Marketing Housing Market